The Taxpayer needs to prepare credit notes and debit notes as per CGST Section 34. Rules of Credit note and Debit Note under GST However, the details of the credit note shall be declared in the return for the month during which the credit note is issued. 31st December following the end of such financial year. However, the credit note shall be issued before September following the end of the financial year or date of furnishing of GSTR 9 annual return i.e. Sufficient documentary evidence has to be built up before such credit notes are allowed. The Deficiency of the supply of goods or services is too opaque or vague reason to justify. No other reason is mentioned in the provisions where credit notes could be issued to adjust GST.

Iii) Goods or services or both supplied are found to be deficient. Ii) Supplier receives the goods back from the customer. I) Taxable value or tax in the GST Invoice is excess Also, the credit note issuer must have valid GST registration. The Taxpayer/supplier can issue Credit Notes under Section 34(1) to the recipient in the below situations. The invoice has to be issued by a registered supplier for supplies to Registered/Unregistered customers.Ģ. A Tax Invoice shall meet the requirements of Section 31(1) of CGST Act/State GST Act for the supply of goods and under Section 31(2) for the supply of services subject to Rule 1 of Invoice Rules. You need to issue a credit note if the tax invoice has been issued earlier against material returned back by the customer.

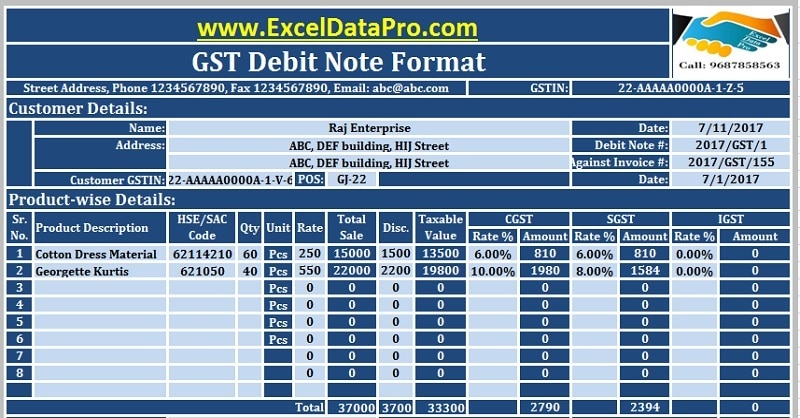

A Customer may receive a credit note from his supplier, if the customer paid too much money, or had been overcharged. Similarly, the supplier can send a credit note to his customer, if the goods are incomplete, not in good condition, or not as per specification. A credit note contains the references of the original Invoice and sometimes it may state the reason for the issue. The Credit note will reduce the amount the buyer has to pay. Also, it can be issued in respect of the previously issued invoice. The supplier may issue a credit note in the case of damaged goods, errors, or allowances. The seller issues a credit note to the buyer if the buyer returned or did not receive the goods or services. The credit note can contain the lists of the products, quantities, and agreed prices for goods or services. In other words, the credit note serves as evidence for the reduction in sales. The Credit notes act as a Source document for the Sales return in Accounting Journal.

#EXCEL ACCOUNTING WITH GST HOW TO#

You will see how to use a credit note shortcut key in tally ERP 9. These formats will serve as a sample with rules under GST.īeyond this, you will learn how to pass credit note entry in tally ERP.

#EXCEL ACCOUNTING WITH GST DOWNLOAD#

Further, you can download credit note format in excel and word from the below tables.

0 kommentar(er)

0 kommentar(er)